Investing 101: How to Build a Solid Financial Plan

In today’s fast-paced world, financial planning has become more critical than ever before. Creating a solid financial plan is essential for individuals and businesses alike, as it allows them to achieve their short and long-term goals and secure their financial future. With the plethora of information available online, it can be overwhelming to navigate the complexities of investing and create a plan that meets your unique needs. However, fear not! We’re here to guide you through the process of building a solid financial plan that can help you achieve your financial aspirations.

Understanding the Basics

Before diving into the specifics of creating a financial plan, let’s have a quick refresher on the fundamental concepts of investing. Investing refers to the act of allocating money or resources in a manner that is expected to generate profit or income over time. It involves purchasing assets such as stocks, bonds, real estate, or mutual funds with the goal of generating returns.

The key to successful investing lies in having a well-thought-out financial plan. A financial plan is a roadmap that outlines your financial goals and the strategies necessary to achieve them. It takes into account your current financial situation, risk tolerance, and investment objectives.

Setting Financial Goals

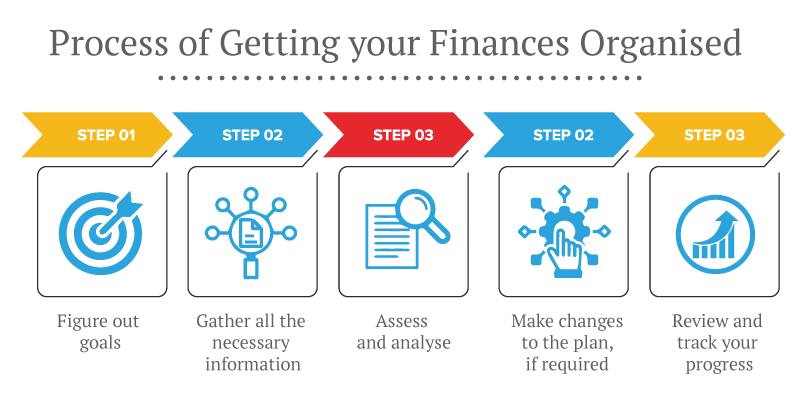

The first step in building a solid financial plan is setting clear and realistic financial goals. Ask yourself, what do you want to achieve financially in the short, medium, and long term? Do you aim to save for retirement, buy a house, start a business, or fund your child’s education? Defining your goals will help shape the overall structure of your financial plan.

Once you have identified your goals, assign specific timeframes and monetary values to each. For instance, if your goal is to save for retirement, determine the age at which you plan to retire and estimate the amount you would like to have in your retirement fund. Having concrete goals with measurable parameters will enable you to track your progress and make necessary adjustments along the way.

Assessing Your Current Financial Situation

To build a solid financial plan, you must have a clear understanding of your current financial situation. Assessing your income, expenses, assets, and liabilities will provide a comprehensive snapshot of where you stand financially. Begin by examining your monthly income from various sources, including your salary, investments, or rental properties.

Next, list down all your expenses, both fixed and variable. Fixed expenses typically include rent or mortgage payments, utility bills, and insurance premiums, while variable expenses may include dining out, entertainment, and travel expenses. Analyzing your expenses will help identify areas where you can potentially cut costs and increase savings.

Apart from income and expenses, take stock of your assets and liabilities. Assets may include savings accounts, investment portfolios, real estate, or any other valuable possessions. On the other hand, liabilities encompass debts such as mortgages, student loans, or credit card balances. Understanding your net worth and debt-to-income ratio is crucial when formulating your financial plan.

Determining Risk Tolerance

Risk tolerance plays a vital role in shaping your investment strategy. Every individual has a different comfort level when it comes to taking risks with their investments. Some individuals might be more risk-averse, preferring low-risk investments with stable returns, while others may be comfortable with higher-risk investments that offer potentially higher returns.

To determine your risk tolerance, consider factors such as your age, financial obligations, and personal preferences. Younger individuals with a longer investment horizon may be more inclined to take higher risks, as they have more time to recover from potential losses. Conversely, those nearing retirement may prioritize preserving their capital rather than chasing higher returns.

Crafting an Investment Strategy

Once you have a clear understanding of your financial goals, current situation, and risk tolerance, it’s time to craft an investment strategy that aligns with your objectives. This is where diversification comes into play. Diversification refers to spreading your investments across different asset classes, industries, and geographical regions to reduce risk.

A well-diversified portfolio includes a mix of stocks, bonds, real estate, and other investment vehicles. Stocks offer the potential for higher returns but come with higher risks, while bonds provide more stability but offer lower returns. Real estate can act as a hedge against inflation and provide a steady income stream.

Consider your risk tolerance, time horizon, and investment knowledge when choosing the right mix of investments for your portfolio. It might be wise to seek the assistance of a qualified financial advisor who can provide expert guidance tailored to your needs.

Monitoring and Adjusting

Building a solid financial plan is not a set-it-and-forget-it process. Regularly monitoring and adjusting your plan is essential to ensure it remains aligned with your changing financial circumstances and goals. Review your plan at least annually or whenever significant life events occur, such as job changes, marriage, or the birth of a child.

Track the performance of your investments and assess whether they are meeting your expectations. Rebalance your portfolio periodically to maintain the desired asset allocation. It may also be necessary to make adjustments to your plan based on changes in your income, expenses, or risk tolerance.

Conclusion

In conclusion, a solid financial plan is the cornerstone of successful investing. By setting clear goals, assessing your current financial situation, understanding your risk tolerance, crafting an investment strategy, and monitoring and adjusting your plan over time, you can work towards achieving your financial aspirations. Remember, building a solid financial plan requires careful consideration and a long-term perspective. With the right approach, you can confidently navigate the investment landscape and secure your financial future.